This blog will cover what a condotel is and how condominium mortgages work. Condominium mortgages is a non-conforming portfolio loan. Condotels are classified as non-warrantable condos. A condotel unit is a private condominium unit inside a hotel that an individual and entity owns.

Condotel Units, also known as Condo-Hotel, have been very popular from the mid-1990s until 2008, when the real estate and financial markets crashed. Gustan Cho Associates are experts in condominium mortgages.

Condotel Unit Benefit Using The Condo and Renting the Unit When Not in Use

A condotel unit owner can enjoy the condotel unit as a second or vacation home one or two months out of the year and rent out the condotel unit the remaining time he or she does not use it.

The Condo-Hotel management staff rents out the condotel unit if you are a member of the Condo-Hotel Rental Program for condotel unit owners.

How Condo-Hotel Owners Make Revenue While Enjoying Condotel Units

The great part about being a condotel unit owner is that the Condo-Hotel management staff can take care of your condotel unit and rent out your condotel unit not for a monthly fee but for a percentage of the rental income your unit receives.

For example, if your condotel rents for $200 per night, the Condo Hotel management will collect the $200 and take a percentage of the $200. The amount they take depends on the Condo Hotel complex, but normally the Condo Hotel complex takes anywhere between 30% to 50%. If the condotel unit does not rent, you are not liable to pay anything.

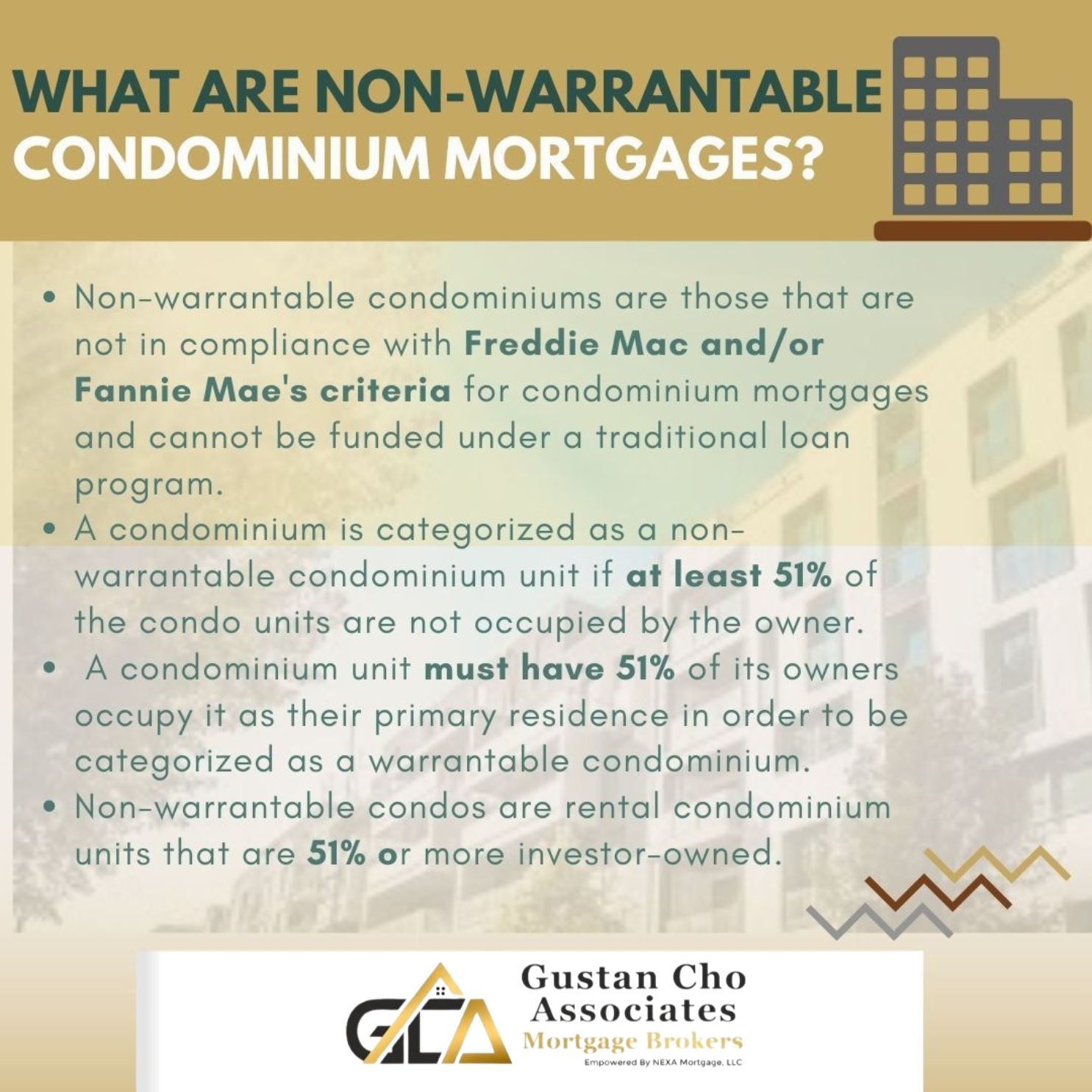

What Are Non-Warrantable Condominium Mortgages?

A non-warrantable condominium is a building that does not conform to Fannie Mae and Freddie Mac condominium mortgage guidelines and cannot be financed through a conventional loan program.

A condominium is classified as a non-warrantable unit mainly because 51% or more of the condo units are not owner-occupied. For a condominium unit to be classified as a warrantable condominium, it needs to have 51% of the condominium owners live in the condominium as owner-occupant. . Non-warrantable condos are 51% or more investor-owned and are rental condominium units.

Non-Warrantable Condo Loans Condominium Mortgages

Condotel loans And Non-Warrantable mortgage loans came to an abrupt halt after the 2008 real estate and credit meltdown. Most Condo-Hotel unit owners have given up on looking for a portfolio mortgage lender who can do condotel and non-warrantable condominium mortgage loans.

Suppose you want to purchase a condotel unit or a non-warrantable condominium or are interested in refinancing your condotel or non-warrantable condominium unit, whether it is for a better rate or to do a cash-out refinance. In that case, the good news is that condominium mortgages and non-warrantable condo financing are becoming more readily available.

Lending Guidelines on Non-Warrantable Condominium Mortgages

Here are the available condominium mortgages And Non-Warrantable Condominium Unit Lending Requirements. However, every portfolio mortgage lender may have their own lending requirements.

Portfolio lender that offers 3/1 ARM, 5/1 ARM, and 7/1 ARM amortized over 30 years. Portfolio mortgage lenders generally do not offer 30-year fixed-rate mortgage loans.

What Are Adjustable Rate Mortgages on Condominium Mortgages?

ARM are Adjustable Rate Mortgages are 30-year loan programs. However, there is a fixed rate period, and after the fixed-rate period expires, the interest rate will adjust yearly for the remainder of the 30-year loan term.

The newly adjusted mortgage interest rate will be set by adding the margin plus the index.

How Do ARMs Work on Condominium Mortgages?

The margin is fixed, but the index can change depending on where the index is when the mortgage interest rate is due to adjust. There are various indexes depending on what the lender on which index they will decide. COFI, LIBOR, and CMT are some common indexes that lenders choose from.

Most condotel mortgage lenders require that Condotel and non-warrantable condominium units need a kitchen and at least one bedroom and are at least 500 square feet. Most condotel lenders require 75% loan to value.on primary home and second home condotel units. This includes Condotel refinance mortgage loans as well as cash-out refinance mortgage loans.

Down Payment Requirements on Non-Warrantable Condominium Mortgages

Most portfolio lenders will require the following: a non-warrantable condominium requires an 80% loan to value on both purchase and refinance mortgage loans.

<

Most condotel mortgage lenders require a minimum credit score of 680 FICO but prefer borrowers to have 700 FICO credit scores or higher. Condo Hotel Complexes and Non-Warrantable Condominium Complexes must be financially and structurally in good standing. Loan sizes by most portfolio lenders range from $100,000 to $3,000,000.

What Are The Comparison of Warrantable vs. Non-Warrantable Condominium Mortgages

Since condotel and non-warrantable condo loans are portfolio loans and do not need to meet Fannie Mae or Freddie Mac Guidelines, the lending standards are set by the portfolio lender, and the portfolio lender is the institution that sets the rules.

Most portfolio lenders require one-year reserves for the primary residence, the condotel, and the non-warrantable condominium unit. Again, this requirement is up to the individual portfolio mortgage lender.

Debt-to-Income Ratio Guidelines on Non-Warrantable and Condo-Hotel Financing

Debt-to-income ratios cannot exceed 43%, including proposed Condotel or Non-Warrantable Condo Purchases and refinance mortgage loans. Reserves are required but do not have to be cash reserves. Retirement accounts, investment accounts, and other liquid accounts can be used as reserves.

Typical reserves required are one-year P.I.T.I. (Principal, Interest, Taxes, Insurance) per each property the borrower owns. For example, if the borrower has a main residence and his P.I.T.I. is $1,000 per month and his proposed P.I.T.I. on his proposed condotel, and non-warrantable condominium purchase is $1,000 per month. The portfolio lender will require $24,000 in reserves.

Best Mortgage Lenders For Condominium Mortgages With No Overlays

Gustan Cho Associates is a full-service national lender with no overlays on government and conventional loans. Gustan Cho Associates has no lender overlays on FHA, VA, USDA, and Conventional loans. Our licensed and support personnel team is available seven days a week, on evenings, weekends, and holidays.

Borrowers who need to qualify for a mortgage with a national lender with no overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.Not all FHA lenders have the same guidelines on condominium mortgages.