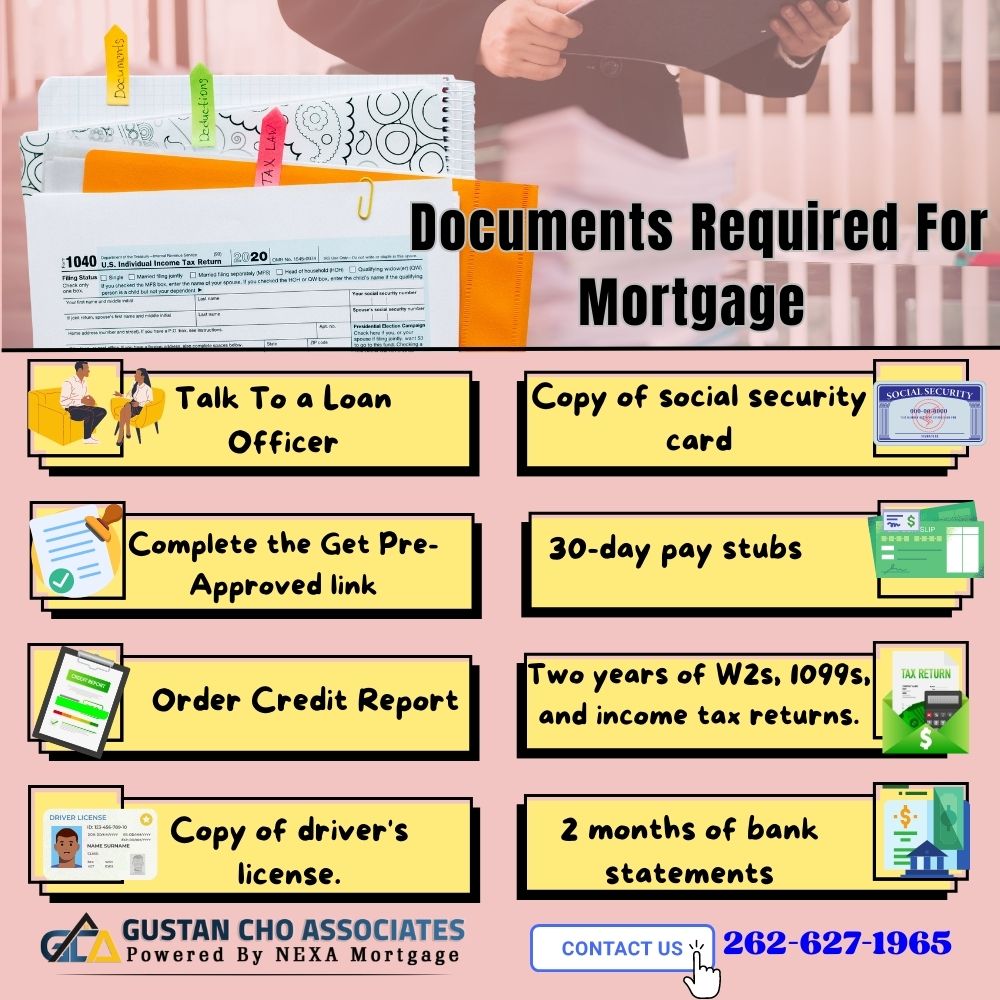

In this guide, we will cover documents required for mortgage approval. To get qualified and get pre-approved, there are three simple steps in the mortgage process. The first mortgage process step is getting qualified and pre-approved by your loan officer. The first and most important step in the mortgage approval process is talking with a loan officer. You should not apply for a mortgage loan or order a credit report without talking with a loan officer first.

Your loan officer will ask you to complete the 1003 mortgage loan application, income docs, paycheck stubs, tax returns, divorce decree, bankruptcy paperwork if applicable, and other documents required to qualify you and issue a pre-approval letter.

The loan officer will go over your debt-to-income ratio and see whether or not you may need a non-occupant co-borrower. The loan officer will then direct you to the link to get pre-approved and also the link to order a tri-merger credit report. By you ordering and paying for the tri-merger credit report, you get to see your tri-merger credit report and credit scores. If the loan officer orders the tri-merger credit report, then you will not have access to the credit report. Regardless, the credit report fee is paid by the borrower. By paying for the tri-merger credit report fee upfront, it will not get charged at closing. The credit score used will be the middle credit score as your qualifying credit score.

Documents Required For Mortgage Pre-Approval

Your loan officer will want to see income documents before they will issue a pre-approval. Documents required for mortgage process depend on each individual borrower.

Documents required for mortgage is uploaded when completing the link the mortgage loan application The Get Pre-Approved link has a section to upload documents required for mortgage pre-approval section.

If a borrower is a salaried wage earner with no side businesses or investment properties, then all the loan officer will need is 30 days of paycheck stubs, two years of W2s, and 60 days of bank statements. If the borrower is a self-employed borrower, then more documents will be required such as income tax returns, business bank statements, and other paperwork.

Importance of Documents Required For Mortgage Loan Approval

During the qualification and pre-approval process, the loan officer should thoroughly comb through the borrower’s credit and income profile and manually go through the tri-merger credit report for credit disputes, duplicate tradelines, and accuracy. A pre-approval letter should never be issued if there are credit disputes on non-medical collections or recent derogatory credit tradelines.

After you have ordered your credit report, you will get a copy of the tri-merger credit report and your loan officer will have access to it. The credit report is required to run the automated underwriting system. Once with an approve/eligible per automated underwriting system, you are set to go. Gustan Cho Associates has no lender overlays. We just go off the automated findings of the automated underwriting system.

The final step prior to issuing a pre-approval letter is the loan officer will run your file through the automated underwriting system (AUS) for automated findings report. If you get an approve/eligible per AUS, the loan officer will issue you a pre-approval letter. If you get a refer/eligible per AUS, the loan officer will see if you qualify for a manual underwrite.

What Are The Documents Required For Mortgage Process

Documents required for mortgage pre-approval depend on each individual borrower. For borrowers who are hourly or salaried wage earners and have no major out-of-normal circumstances, the following is required:

- Copy of front and back of driver’s license and social security card

- 30 days of paycheck stubs

- Two years of W2s

- Sixty days of bank statements showing funds to be used for the down payment and closing costs

- 401k or investment account statements

For borrowers with a prior divorce, they need to provide a divorce decree.

Special Documents Required For Mortgage Approval

Borrowers who has certain unique circumstances need to provide the following documents pertaining to them:

- Divorce decree if applicable

- Bankruptcy schedule and discharge if applicable

- Two years of income tax returns if self-employed if only schedule c, K1s business returns for the 1120s or partnerships. (easier to get them now instead of later).

- 2 years the 1040s need to be Signed and dated.

- DD214 Certificate of Eligibility for VA loans

- Copy of employment offer letter if starting a new job if applicable.

- Bonus, overtime, commission, and part-time income can be used if seasoned for two years.

- Source large deposits other than pay stubs.

- All CASH deposits have to be sourced and if cannot source them, applicants most likely will not be able to use those funds.

- Homebuyers using social security income, need social security award letter.

- If using pension income to qualify, need a pension – award letter.

- Copy of most recent mortgage statement(s) on primary home and all real estate holdings.

Manual Underwriting on FHA and VA Loans

FHA and VA loans are the only two mortgage loan options that allow manual underwriting. If you meet the FHA or VA manual underwriting guidelines, a pre-approval letter will be issued. Once the loan officer qualifies and the borrower meets all the agency guidelines, a pre-approval will be issued. With a pre-approval letter, the borrower can go and shop for a house and enter into a real estate purchase contract.

FHA and VA has the same mortgage guidelines when it comes to manual underwriting. On manual underwriting, verification of rent is required.

Verification of rent is only valid if the borrower can provide 12 months of canceled checks or twelve months of bank statements showing rent payments were paid timely in the past 12 months. Verification of rent form will be provided by the lender for the landlord to complete, sign, and date.

Renters renting their apartment or home from a registered property management company do not need to provide verification of rent. The rental verification form provided by the lender can be completed, signed, and dated by the property manager in lieu of providing 12 months of canceled checks or bank statements.

Gustan Cho Associates waives verification of rent for borrowers who are living rent free with family to save money for a home purchase. A living rent free letter will be provided by the mortgage lender to be completed by the property owner.