In this article, we will cover the topic of how you can qualify for a mortgage with defaulted student loans. You do not have to pay outstanding private defaulted student loans to qualify for a mortgage. Homebuyers can qualify for conventional and non-QM loans with defaulted federal student loans. However, you may have a difficult time getting an approve/eligible per an automated underwriting system with defaulted student loans on conventional loans.

Fannie Mae and Freddie Mac Guidelines on Defaulted Student Loans

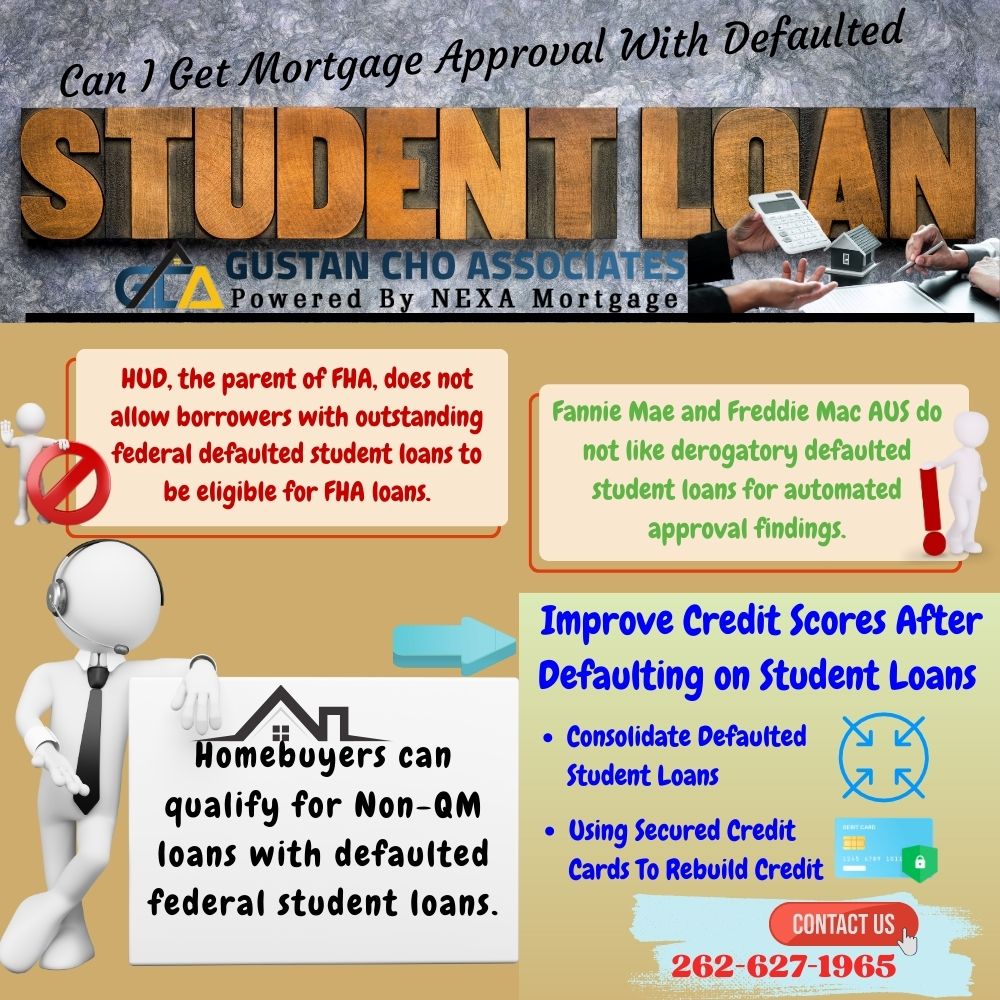

Fannie Mae and Freddie Mac AUS do not like derogatory defaulted student loans for automated approval findings. You cannot qualify for government-backed mortgages with federal defaulted student loans.

Private student loans are no different than having delinquent installment loan debts. Defaulted private student loans are treated no differently than a traditional charge-off account.

However, you cannot qualify for a government-backed mortgage with outstanding federal defaulted student loans. HUD, the parent of FHA, does not allow borrowers with outstanding federal defaulted student loans to be eligible for FHA loans. In the following paragraphs, we will cover qualifying for a mortgage with outstanding defaulted student loans.

Getting a Mortgage With Defaulted Student Loans

Defaulted student loans need to be out of collections if it is a federal student loans for FHA loans. It used to take nine months to cure defaulted student loans for FHA loans. However, HUD, the parent of FHA, updated its rehabilitation program on federal student loans. You can now rehabilitate defaulted student loans in 30 days or less with the derogatory credit being removed from your credit report.

How To Improve Credit Scores After Defaulting on Student Loans

Let’s face it, when you consider the times we live in today, it is very easy to find yourself financially tight. You had started paying off your student loans, but for some reason, life happened, and you missed a few payments, and now you are in default status. And you know what this means? Your credit score will be affected – and that’s, not good news!

The reason being should you decide to apply for a mortgage in the near future, you won’t qualify. The good news, however, is that this issue is easily fixed. It is possible to rebuild your credit score even after you’ve defaulted on your student loan.

There are specific steps you can take to repair your credit, and the truth is, it won’t be easy at all. It can be a lengthy process, but with hard work, you will see a positive result in a matter of months. Here are some top tips and strategies for rebuilding your credit after defaulting on your student debt. Get out of default To start rebuilding your credit score, you must get out of debt first. Now, there are three ways through which you can achieve this, including paying off your debt, rehabilitating the debt, and consolidating the loan.

Paying Off Debt To Improve Credit After Defaulted Student Loans

Pay off the debt – this got to be the simplest way to get out of default is by paying your debt in full. However, this is easier said than done, given that many people have their student debt going into tens of thousands of dollars, But there are other options!

Rehabilitate Defaulted Student Loans

Rehabilitate your student debt – by being in default status, it will show on your credit report, negatively affecting your credit score. One of the best ways to get out of default status is by rehabilitating your debt.

What this means is that you will come to an agreement with the loan provider for you to pay a low monthly amount for about nine months.

Once you follow through with this plan, making on-time payments each month, the default status will be dropped from your credit report. Even though this won’t erase any late or missed payments already included on your credit report, it will for sure help improve your credit score slightly.

Consolidate Defaulted Student Loans

Consolidate your debts – the next best thing you can do if you are looking to rebuild your credit score is to consolidate your loans. Essentially, loan consolidation means combining multiple debts into a single, larger debt to simplify the repayment.

When you decide to consolidate defaulted federal student loans, especially into a Direct Consolidation Loan, you will have to agree to repay the debt with an income-driven repayment plan or make three consecutive on-time payments towards the debts before consolidating.

But unlike debt rehabilitation, simply consolidating your debt won’t necessarily remove the default status of your credit report, which is why it is recommended that you first attempt to rehabilitate the debt before you choose loan consolidation.

Make Your Defaulted Student Loans on Time After Rehabilitation

Commit to making payments on time. When calculating credit scores, the payment history does account for the largest share, which means that if you have a history of late payments, it will bring down the score.

Making on-time payments would be a positive step towards recovering from the default. One way to ensure you achieve this is by opting for an income-driven repayment plan, making your monthly payment much more comfortable for your budget.

This repayment plan bases your monthly payments on your discretionary income and household size. The income-driven repayment plans currently offered include; the Pay As You Earn (PAYE) plan, Revised Pay As You Earn (REPAYE) plan, income-based repayment (IBR) plan, and income-contingent repayment (ICR) plan. With PAYE and REPAYE plans, the monthly payment is capped at 10% of your income, giving you about 20 years to clear your undergraduate and 25 years for graduate school loans.

Income-Based Repayment on Defaulted Student Loans

For ICR and IBR, the payment is capped at 20% and 10% of your income, respectively, where IBR gives you 20 years to clear and ICR 25 years. Once you agree to a repayment plan, make sure you make on-time payments throughout the agreed period. Enroll in an auto-pay system with the loan servicer, or if that option isn’t available, you can set up payment reminders through the lender. And paying on time shouldn’t just apply to your student debt repayments, but you should also make a point of paying all other bills on time.

Using Secured Credit Cards To Rebuild Credit With Defaulted Student Loans

Consider a secured credit card to rebuild your credit. When you are looking to rebuild your credit after defaulting on your student loans, your credit cards can be the fastest way. As we mentioned above, while it is true that your payment history is what is largely relied upon on credit score calculations, your credit utilization is the second-most important factor.

Credit utilization refers to the amount of available credit you use at any given time. So, using your credit card to make purchases, and paying it off on time, thereby keeping your credit utilization low, will help improve your credit score.

Having defaulted on student loans, getting a traditional credit card is almost impossible. So, you will need to apply for a secured credit card instead. A secured credit card requires you to deposit cash, doubling your credit line. For instance, you may be asked to deposit about $500 in your account when you apply for a credit card, which means that once your account is open, you will have a $500 limit.

Secured Versus Unsecured Credit Cards For Rebuilding Credit

In every other aspect, these credit cards work the same as regular credit cards, where you can make a purchase against your credit limit and then pay it back with interest. Even with this card, make sure you keep making on-time payments, as it will help you improve your credit score by re-establishing a positive credit history. In addition, some lenders would convert your credit card to a regular card and possibly even refund your deposit once they are convinced that you’ve become responsible. Another crucial detail you need to remember is that you must always check with your credit card issuer that he reports your credit card activities to the credit bureaus. Otherwise, all the efforts you will be making will go to waste and won’t count in your attempt to rebuild your credit score.

How To Rebuild Credit After Defaulted Student Loans

Consider a credit-building loan with secured credit cards and credit rebuilder loan programs from banks or credit unions. Credit builder loans can also help you rebuild your credit. These loans are similar to secured credit cards, where you will need a cash deposit as collateral, with some requiring your savings to act as collateral. Many lenders, including banks, online lenders, and credit unions, offer these loans. Once you clear the loan, the amount used as collateral will then be refunded together with the interest earned. All the payments made towards the loan will then be reported to the credit bureaus.

Getting Approved For a Mortgage After Defaulted Student Loans

After defaulting on your student loans, rebuilding your credit score is something you can only do after a period of time. It takes time, so patience is key! Consistent, responsible credit habits, including making payments on time, will undoubtedly go a long way in making progress. Remember, as you tirelessly work to re-establish your credit, check your credit reports regularly to track the progress. If you need any help or advice, you can always hire a financial expert to guide you on the best ways to rebuild your credit faster and sustainably.