In this guide, we will cover VA streamline refinance mortgage loans. We will discuss how VA streamline refinance mortgage loans work and how a streamline can save you tens of thousands of dollars over the term of your VA loan. John Strange of Gustan Cho Associates is a licensed loan officer and VA loan expert. John explains VA loans as follows:

As a veteran or active-duty military personnel, you may have taken advantage of the benefits of a VA home loan to purchase your home. VA loans come with several benefits, such as competitive interest rates, exemption from making a down payment, and the absence of mortgage insurance.

However, if you’ve had your VA loan for a while, you may be paying a higher interest rate than currently available. You may be able to refinance your VA loan using the VA streamline refinance program. In this article, we’ll cover everything you need to know about VA streamline refinance, including how it works, who qualifies, and the benefits.

What is VA Streamline Refinance?

The Interest Rate Reduction Refinance Loan (IRRRL), commonly referred to as the VA streamlined refinance program, is a refinancing option available to veterans and active-duty military personnel with an existing VA home loan.

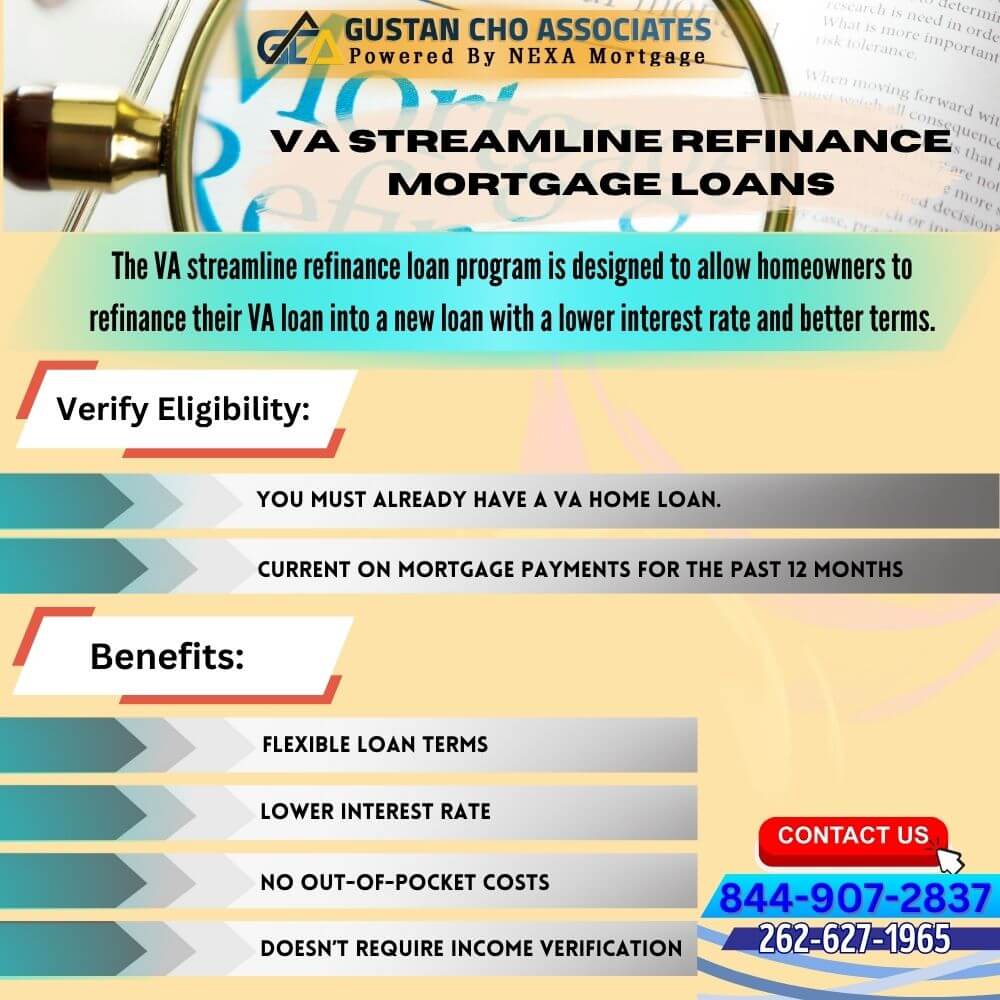

The VA streamline refinance loan program is designed to allow homeowners to refinance their VA loan into a new loan with a lower interest rate and better terms.

One of the key benefits of the VA streamlined refinance program is that it’s a simplified process that doesn’t require much paperwork or a new appraisal. Instead, the process is streamlined to help homeowners quickly and easily refinance their existing VA loan into a new loan with a reduced interest rate.

VA Streamline Refinance Eligibility Requirements

Verify Eligibility: To be eligible for VA streamlined refinance, you must already have a VA home loan and be current on your mortgage payments. VA streamlines only for rate and term. According to Dale Elenteny, a senior loan officer at Gustan Cho Associates, you cannot do a cash-out on a VA streamlined mortgage.

It would help if you refrained from using VA streamline refinance to cash out equity in your home or pay off non-VA loans. The loan you’re refinancing must be a VA loan, and you must refinance to a VA loan.

Find a Lender: You can work with any VA-approved lender to apply for VA streamline refinance. Some lenders may have specific requirements, so shopping around and finding a lender that meets your needs is essential. VA streamline refinance works similarly to a traditional refinancing process but with fewer requirements and less documentation. In the following subsections, we will go over a rundown of the mechanics of the VA streamline refinance mortgage loan program.

Credit Check and Income Verification

One of the most significant advantages of VA streamline refinance is that there is no need for a new appraisal or credit check. It implies you can qualify for the refinancing program without furnishing new documents or undergoing another underwriting process. The entire VA streamlined mortgage process should not take longer than two weeks, according to Ronda Butts:

Complete the Application: Once you’ve found a lender, you must complete an application for VA streamline refinance. The application will require you to provide essential details about yourself, your present mortgage, and the new loan.

Close the Loan: After your application has been approved, you must sign the necessary paperwork to close the loan. The closing process is similar to the process you went through when you first obtained your VA loan.

Who Qualifies for VA Streamline Refinance

To qualify for VA streamline refinance, you must meet the eligibility requirements of the Veterans Administration. Borrowers need an existing VA home loan: You must already have a VA home loan to be eligible for VA streamline refinance. Wendy Lahn of Gustan Cho Associates explains what net tangible benefit is:

You must prove that you will benefit from the refinancing program. The benefit borrowers need is the net tangible benefit in order to be able to do a VA streamline refinance loan. The benefit must be either a lower interest rate, a shorter loan term, or a switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

You must be current on mortgage payments for the past 12 months. You must be current on your mortgage payments to qualify for VA streamline refinance mortgage loans. You can have up to one 30-day late payment in the last year. VA streamline refinance loan is when you are refinancing your old VA loan to another VA loan. You must refinance to a VA loan to be eligible for VA streamline refinance.

Benefits of VA Streamline Refinance

VA streamlined refinance offers many benefits for homeowners with an existing VA loan. Michael Gracz of Gustan Cho Associates is a VA streamline refinance mortgage expert.

With its streamlined process, flexible loan terms, and no out-of-pocket costs, VA Streamline refinance is an excellent option for qualified homeowners.

VA streamline refinance is a no-brainer. You can save tens of thousands of dollars over the loan term. The following sections will cover the many benefits of VA streamlining refinance mortgage loans.

Lower Interest Rate

The primary benefit of VA streamline refinance is obtaining a lower interest rate on your mortgage. It can help you reduce your expenses on monthly mortgage payments, reduce the total interest on the total amount you pay during the loan term, and even pay off your mortgage sooner. VA streamline refinance loans do not require a new home appraisal, according to Zack Hoyer of Gustan Cho Associates.

VA streamline refinance doesn’t require a new appraisal, saving you time and money. It is because the VA assumes that the value of your home has remained relatively stable since you obtained your original VA loan.

VA streamline mortgage loans are designed to save time and money for homeowners, and it doesn’t require a new appraisal, credit check, or income verification. To qualify for VA streamline refinance, you must have an existing VA home loan and be current on your mortgage payments.

No Income Verification on VA Streamline Refinance

VA streamline refinance doesn’t require income verification, which can be helpful if your income has decreased since you first obtained your VA loan. There are no pre-payment penalties on government and conventional loans. VA loans do not have a pre-payment penalty, according to Dale Elenteny of Gustan Cho Associates.

VA streamlined refinance with no prepayment penalty. It means that homeowners can pay off their mortgage early without penalty fees.

There are multiple VA streamlined refinances for homeowners to choose from different loan terms, including 15, 20, or 30-year fixed-rate mortgages. It allows homeowners to choose a loan term that fits their financial situation.

No Out-of-Pocket Costs

VA streamline refinance doesn’t require any out-of-pocket costs. The expenses and charges can incorporate the refinancing program into the new loan. It means homeowners don’t have to pay any upfront costs to refinance their mortgage.

With a lower interest rate and monthly payments, homeowners can increase their cash flow, which can help pay off other debts, save for retirement, or make home improvements.

Refinancing a new loan with a lower interest rate can help improve your credit score. Reduced interest rates translate to lower monthly payments, which may aid you in keeping up with your mortgage payments.

Things to Consider Before Applying for VA Streamline Refinance

Before applying for VA streamlined refinance, you should consider a few things. While there are no out-of-pocket costs for VA streamlined refinance, you may still have to pay closing costs. These can roll these costs into your new loan, but they will increase the total amount you owe. Not all lenders have the same rates and fees on VA streamline refinance loans:

Some lenders may charge a fee for VA streamline refinance. It is advisable to verify with your lender any applicable fees and their corresponding amount.

While VA streamline refinance offers flexible loan terms, it’s important to remember that a longer loan term may result in additional interest charges throughout the loan term. You should carefully consider which loan term is right for you based on your financial situation. Amanda Witthauer of Gustan Cho Associates explains the costs and fees of VA streamline refinance as follows:

Some lenders may charge a fee for VA streamline refinance. It is advisable to verify with your lender any applicable fees and their corresponding amount.

While VA streamlines refinance can result in a lower interest rate, it’s important to remember that the interest rate you qualify for may depend on various factors, including your credit score and the current market conditions. Evaluating if the possible savings outweigh the time and effort involved in refinancing is crucial.

How Does The VA Streamline Mortgage Process Work

VA streamlined refinance, an excellent option for veterans and active-duty military personnel with a VA home loan. It’s a streamlined process that allows homeowners to refinance their existing VA mortgage into a new loan with a lower interest rate and better terms.

VA streamline mortgage could be a smart financial decision if you meet the eligibility requirements. Before applying for VA streamline loans, consider your financial situation, the potential savings, and any fees or costs associated with the refinancing process.

Borrowers considering VA streamlined mortgage loans would best compare offers from different lenders to find the best interest rate and terms for your needs. Overall, VA streamlined mortgage is a valuable tool for veterans and active-duty military personnel who aim to decrease their monthly mortgage payments, lower their total interest costs, or pay off their mortgage sooner.