Most loan programs have a minimum down payment requirement on home purchases. Most home mortgage loan programs require a down payment on a home purchase loan. The down payment shows the borrower has skin in the game. Mortgage companies view the borrower as less risky if the borrower puts a larger down payment.

Gustan Cho Associates offer down payment assistance home purchase programs that is forgivable after six months. Gustan Cho Associates first-time homebuyer down payment assistance program is an FHA loan program that requires a 620 credit score and the debt-to-income ratio cannot be greater than 48.99%. The down payment is forgivable after six months.

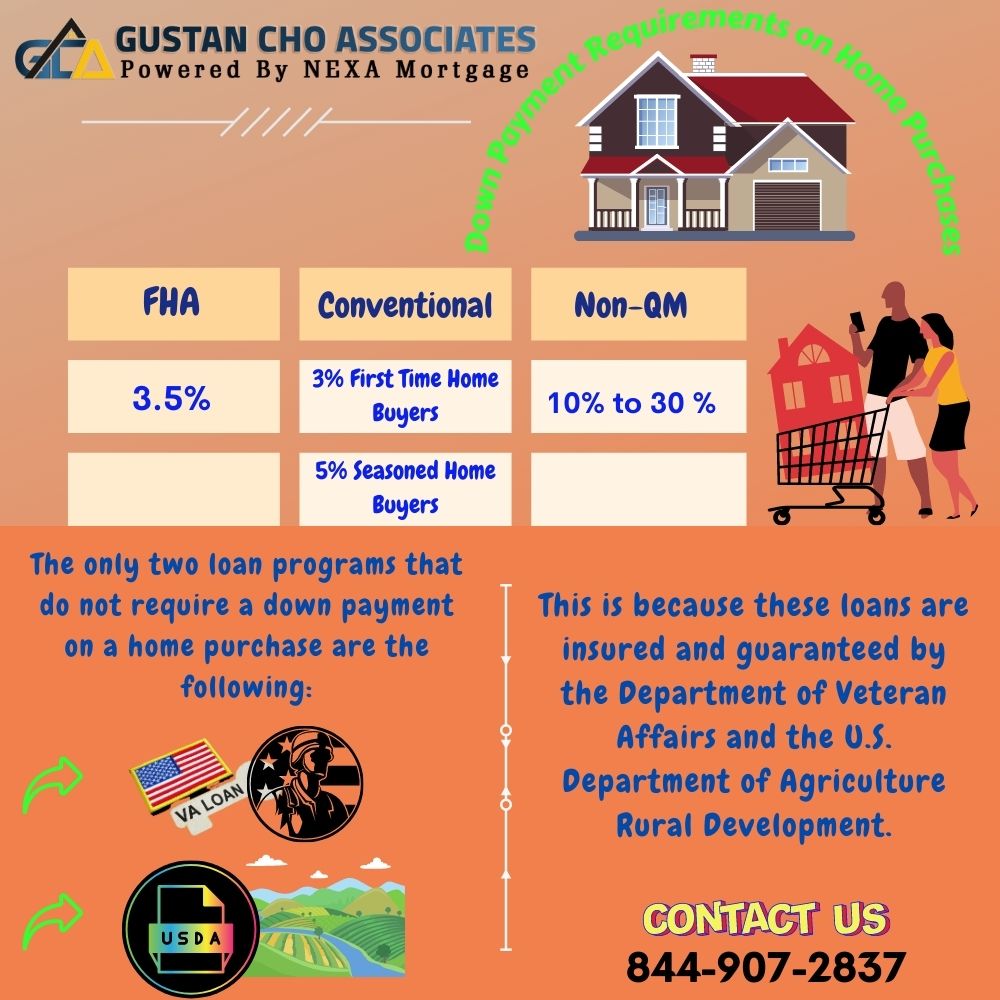

The down payment or loan-to-value is one of the most important factors when determining the mortgage rates of the borrower. In the following paragraphs, we will cover the down payment requirements on government, conventional, and non-QM loans. Owner-occupant government-backed and conventional loans have the lowest down payment requirements versus non-QM loans.

How Down Payment Requirements Work on Home Purchases

The larger the down payment or lower the loan to value, the lower the risk, which means the lower the rate. The only two loan programs that do not require a down payment on a home purchase are the following:

- VA Loans

- USDA Loans

VA and USDA loans do not require down payment requirements on home purchases. The Department of Veteran Affairs and the U.S. Department of Agriculture Rural Development insure and guarantee VA and USDA loans.

Closing Costs on a Home Purchase

All home purchases have closing costs. Most homebuyers will have closing costs covered with a seller concession or lender credit. Most homebuyers do not have to worry about coming up with the closing costs on a home purchase. Dale Elenteny of Gustan Cho Associates said the following about closing costs:

Homebuyers who cannot come up with closing costs can get closing costs covered with seller concessions or lender credit. Or the combination of both seller concessions and lender credit.

An experienced loan officer can guide homebuyers on how to structure the seller concession with their real estate agent for closing costs. The loan officer can structure the closing costs required by borrowers by quarterbacking the home purchase negotiation with the seller by discussing it with the buyer’s real estate agent.

Down Payment Requirements on Home Purchases on Government and Conventional Loans

Homebuyers do not have to pay down on VA and USDA loans. Lenders offer 100% financing at great competitive rates on VA and USDA loans due to the government guarantee. In the event the borrower defaults on a government-backed mortgage. The government agency will partially guarantee the loss of the lender.

HUD, the parent of FHA, requires homebuyers to put a 3.5% down payment on a home purchase FHA loan. Conventional loans require a 3% down payment for first-time homebuyers and 5% for seasoned homebuyers.

Lenders must follow Fannie Mae and Freddie Mac GSE agency guidelines. Lenders fund conventional loans using their warehouse line of credit. After they fund the loan, lenders need to sell the loan funded on the secondary market. Fannie Mae and Freddie Mac are the two largest financial institutions that purchase mortgages on the secondary market.

What Are The Roles of Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac’s role stabilizes the market by purchasing funded loans from mortgage companies. This is how lenders can continue originating and funding loans. Mortgage lenders of conventional loans follow the strict lending requirements of Fannie and Freddie. Suppose lenders expect Fannie Mae and Freddie Mac to purchase loans on the secondary market. In that case, the loan they originate and the fund must conform to Fannie and Freddie’s agency guidelines.

Lenders use their warehouse line of credit to originate and fund mortgage loans. Once they fund the loan, lenders package up the loans and sell them to the secondary mortgage market. Fannie Mae and Freddie Mac are the two largest buyers of mortgage-backed securities on the secondary market.

Lenders need to sell the loans they fund and pay down the warehouse line of credit to keep originating and funding more loans repeatedly. FHA and Conventional loans are the two most popular loan programs in the nation due to the low down payment requirements.

Down Payment Requirements on Non-QM Loans

Non-QM loans generally require a 10% to 30% down payment. The down payment on non-QM mortgages depends on the lender’s layered risk factor. The lower the borrower’s credit scores, the lender will view it as high risk and charge a higher mortgage rate. Credit scores are the most important factor in pricing mortgage rates. The higher the risk, the higher the down payment, and the higher the mortgage rates.

Borrowers of non-QM mortgages can put a 10% down payment on a home purchase with a 720 credit score. Non-QM mortgages one day out of bankruptcy and foreclosure require a 30% down payment. Jumbo mortgages require a 20% to 30% down payment.

There is no mortgage insurance required on non-QM mortgages. Non-QM mortgage rates are based on the down payment and the borrower’s credit scores. Gustan Cho Associates has a specialty traditional 90% LTV jumbo loan program with up to a 50% debt-to-income ratio cap. The minimum credit score for the 10% down payment traditional jumbo loan program is 660 FICO.

Can Seller Concessions Be Used For Down Payment?

Seller concession is when a home seller offers to pay for the buyer’s closing costs. There are two types of costs involved in home purchases:

- Down Payment

- Closing Costs

The down payment requirements on home purchases are mandatory, and seller concessions cannot be used for the down payment.

Seller Concession Mortgage Guidelines

Every loan program has restrictions on the number of seller concessions allowed. Here are the maximum amount of seller concessions allowed:

- HUD allows up to 6% of seller concession

- VA loans allow up to 4%

- USDA loans allow up to 6%

- Jumbo mortgages normally allow up to a 3% seller concession, but it depends on the individual lender.

- Non-QM and specialty lenders normally allow up to a 6% seller concession, but it depends on the individual lender.

Fannie Mae and Freddie Mac Allow 3% sellers concession for owner-occupied and second homes and 2% for investment homes.

Down Payment Requirement For Home Purchases

Every loan program has its down payment requirements on home purchases. Government and conventional loans have their down payment requirements mandated by the agency. Government loans are for primary owner-occupant mortgages only. You cannot finance second homes or investment properties with FHA, VA, or USDA loans.

Conventional loans allow second home and investment property financing and have separate down payment requirements. Jumbo, Non-QM, and specialty mortgages are portfolio loans. Portfolio loans are not insured by any government agency and are not sold to Fannie Mae and Freddie Mac. Portfolio loans are either held by the investor funding the loan or sold to financial institutions such as hedge funds, insurance companies, or other large financial institutions.

Non-QM and alternative mortgage loan programs’ down payment requirements depend on the individual investor. The down payment requirements on jumbo loans depend on the individual investor. Every portfolio lender can have its mortgage lending requirements and guidelines.

Down Payment Requirements on Government and Conventional Loans

This section will cover the down payment requirements for each type of mortgage loan program. Primary owner-occupant homebuyers get the lowest down payment. There are many first-time homebuyer mortgage incentives such as lower down payment, lower rates, and first-time homebuyer programs.

Per Fannie Mae and Freddie Mac agency guidelines, a first-time homebuyer is a buyer who has not owned a home in the past three years. Private mortgage insurance is required for homebuyers who put less than a 20% down payment on a home purchase on conventional loans. Conventional loans are not government-backed loans.

Each mortgage loan program has its down payment requirements. Government and conventional loans have lower down payment requirements versus jumbo and non-QM loans. We will cover each mortgage loan program’s down payment requirements.

HUD Down Payment Requirements on Home Purchase For FHA Loans

HUD requires a 3.5% down payment on home purchases on FHA loans. Borrowers with credit scores down to a 500 FICO are eligible for an FHA loan. HUD requires borrowers under a 580 credit score and down to a 500 FICO to put a 10% down payment versus the 3.5% down payment.

Fannie Mae Down Payment Requirements on Conventional Loans

Fannie Mae and Freddie Mac require a 3% to 5% down payment on Conventional Loans. A 3% down payment on conventional loans applies to first-time homebuyers.

FHA, VA, and USDA loans are for owner-occupant properties. Second homes and investment properties are not eligible for FHA, VA, or USDA financing. Conventional and non-QM loans have loan programs for second homes and investment home loans.

A first-time homebuyer is a buyer who was not a homeowner in the past three years. If you have owned a home in the past three years, you must put a 5% down payment on a conventional loan.

VA Down Payment Requirements on VA Loans

VA loans are the best mortgage loan program in the nation. However, VA loans are limited to eligible veteran borrowers only. There is no maximum loan limit on VA loans. There is no maximum debt-to-income ration on VA loans.

VA loans have the lowest mortgage rates than any other mortgage loan program. The U.S. government created and launched VA loans to reward out brave men and women in uniform.

There is no annual mortgage insurance premium on VA loans. VA does not have any down payment requirements on home purchases. There is no minimum credit score requirements on VA loans.

USDA Down Payment Requirements on USDA Loans

There is no down payment requirement on USDA loans. However, only homes in rural areas are eligible for USDA loans.

Non-QM Down Payment Requirements

Non-QM Loans require a 10% to 30% down payment. Down payment on bank statement loans requires a 20% down payment. Condotel loans require a 25% down.

There are hundreds of non-QM mortgage loan programs. Non-QM Loans require higher down payment requirements versus traditional mortgage loans.

Non-Warrantable Condos require a 20% down. Fix and Flip Loans require 15% down and 10% down on the rehab amount. Jumbo mortgage down payment requirements varies from 10% to 30%. Investment homes require a 20% to 30% down payment.

Down Payment Requirements With Gift Funds

All mortgage agencies and lenders allow gift funds to be used as a down payment and closing costs on home purchases. However, lenders and the Automated Underwriting System do not view gift funds favorably. Ronda Butts explains about own funds versus gift funds on a down payment for a home purchase:

The automated underwriting system does not view gift funds favorably. The AUS gives more weight to borrowers who use their own seasoned funds for the down payment on a home purchase versus gifted funds from family.

Gift funds can be from family members and relatives of borrowers and employers. Gift funds can be used only for a home purchase’s down payment and closing costs. Reserve funds cannot be gifted funds.

Can Gift Funds Be Used For Reserves on Home Purchases?

Reserves are one month of principal, interest, taxes, and insurance PITI. So if a lender asks for six months of reserves, it means the lender wants to see six months of PITI of the borrower’s funds. Reserves do not always need to be in cash. Reserves are not tied up. You can use the reserves in any way or form after you close on your home.

Stocks, bonds, and other liquid documented assets and securities can be used as reserves. Reserve requirements are common for borrowers with less-than-perfect credit or higher-risk borrowers with non-QM and jumbo loans.

No-doc home loans require a 20% down payment, and the reserves depend on the borrower’s credit scores. Borrowers with a 720 credit score only require six months of reserves. For mortgage borrowers with a 640 credit score, no-doc mortgages require 18 months in reserves.

How Does Gift Funds Work During The Mortgage Process

For homebuyers who are dependent on gift funds, here is how gift funds on home purchases work. 100% of gift funds can be used for the down payment and closing costs on home purchases. The donor of gift funds needs to sign a gift letter provided by the lender.

The gift Letter needs to state funds provided to the borrower are solely a gift. The gift is not a loan and will not be paid back. The donor of gift funds needs to provide 30 days bank statement reflecting that the gifted funds are seasoned for at least 30 days.

The borrower must provide a copy of the gift check and bank deposit slip. Updated bank statement after the deposit of gift funds needs to be provided to the lender.

Down Payment Requirements From Other Sources

Homebuyers can use their 401k and retirement accounts for their down payment on a home purchase. Homebuyers can borrow up to 60% of their 401k value and use that for home purchases. The amount they borrowed from their 401k and retirement account will not count towards their debt-to-income ratios because they are borrowing funds that belong to them.

If you have any questions, please contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Borrowers can email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

We are a mortgage company licensed in multiple states with no lender overlays on FHA, VA, USDA, and conventional loans. Gustan Cho Associates have lending partnerships with wholesale non-QM investors.

Non-QM and Alternative Financing Mortgage Options

They can offer dozens of alternative and special loan programs such as no-doc loans, 12-month bank statement loans for self-employed borrowers with no income tax required, asset-depletion, P and L stated income loans, Michael McCue of Gustan Cho Associates said the following about non-QM and alternative financing mortgage loan options:

Over 80% of our borrowers at Gustan Cho Associates could not qualify at other mortgage companies. The team at Gustan Cho Associates are experts in being able to do mortgage loans other mortgage lenders cannot do. We are experts in helping borrowers with non-QM loans.

No Income No Asset Loans, cash-flow rental income mortgages, and dozens of other loan programs for direct owner-occupant loans, second homes, and investment properties. Over fifty percent of our borrowers at Gustan Cho Associates are borrowers of non-QM loans. If you need to qualify for a mortgage with a national lender who can approve loans other lenders cannot, please contact Michelle McCue at Gustan Cho Associates at michelle@gustancho.com or call Michelle at 815-593-4122. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.