This guide covers how the mortgage underwriting process works. If you are planning to buy a house and need a loan, you must go through the mortgage underwriting process called underwriting. Alex Carlucci, a senior loan officer at Gustan Cho Associates, explains how the mortgage underwriting process works as follows:

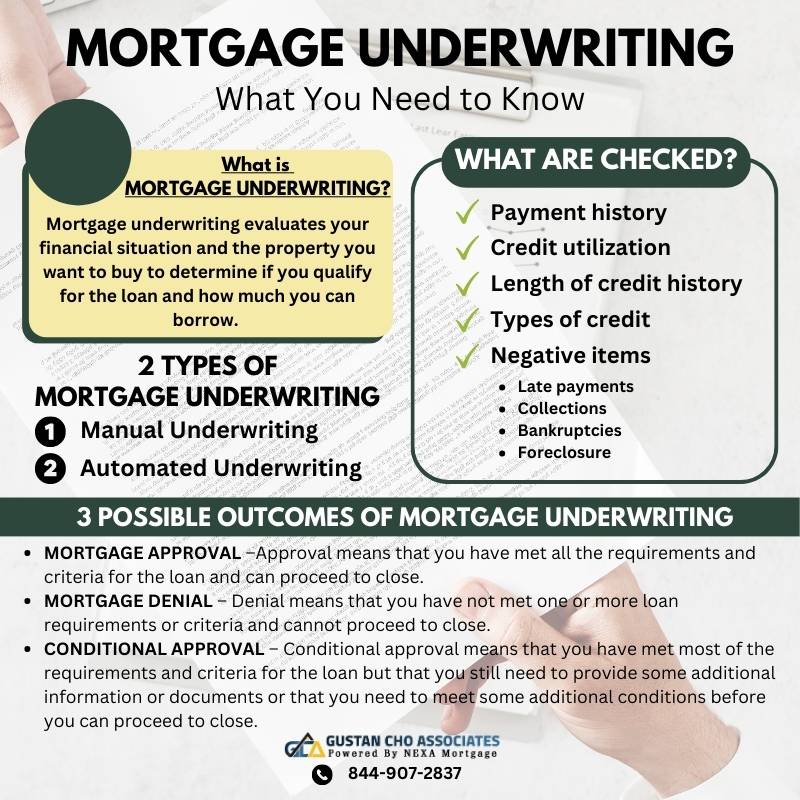

Mortgage underwriters will check your credit report from one or more of the major credit bureaus (Equifax, Experian, or TransUnion) and look at your payment history, credit utilization, length of credit history, types of credit, and any negative items, such as late payments, collections, bankruptcies, foreclosures, etc. In addition, your creditworthiness will be assessed by considering your credit score, which is a numerical indication ranging from 300 to 850.

The mortgage underwriting process evaluates your financial situation and the property you want to buy to determine if you qualify for the loan and how much you can borrow. The mortgage underwriting process is a crucial step in the home buying process, as it can affect your chances of getting approved for the loan and the terms and conditions of the loan.

What are the main factors in the mortgage underwriting process

Mortgage underwriters look at three main factors when assessing your loan application: credit, income, and collateral. These factors are also known as the three Cs of mortgage underwriting. Credit: Your credit history and score show how well you have managed your debts in the past and how likely you are to repay your loan on time.

Typically, the higher your credit score, the greater the likelihood of loan approval and obtaining a more favorable interest rate. Capacity: Your income reflects both the amount you earn and the stability and reliability of your income source. When assessing your mortgage application, underwriters will validate your income by examining your pay stubs, tax returns, W-2 forms, bank statements, and other relevant documents that verify your income.

Additionally, they will consider your debt-to-income ratio (DTI), the percentage of your monthly income allocated towards debt repayment. Typically, a lower DTI enhances your approval prospects and increases the possibility of obtaining a larger loan. Collateral: Your collateral is the property you want to buy with the loan.

What are the different types of mortgage underwriting?

You need to know some things about mortgage underwriting and how it works. We will discuss what is the mortgage underwriting process and how it works. The process of mortgage underwriting varies depending on factors such as the type of loan you’re applying for and the specific lender you’re working with. Here are some common types of mortgage underwriting:

- Manual underwriting: Manual underwriting is when a human underwriter reviews your loan application and documents and decides based on their judgment and experience.

- Automated underwriting: Automated underwriting is when a computer program or software analyzes your loan application and documents and decides based on a predefined set of rules and guidelines. Automated underwriting can be faster and cheaper than manual underwriting, as it can process more applications in less time and with fewer errors.

Manual underwriting can be more flexible and lenient than automated underwriting, as it can consider more factors and circumstances that might not fit into a standard formula or criteria. Manual underwriting can be more time-consuming and costly than automated underwriting, requiring more human resources and expertise.

What are the possible outcomes of mortgage underwriting?

Automated underwriting can be more consistent and objective than manual underwriting, as it does not involve human bias or emotion. However, automated underwriting can also be more rigid and strict than manual underwriting, it might not account for nuances or exceptions that affect your eligibility or suitability for the loan. Mortgage underwriting can result in one of three possible outcomes: approval, denial, or conditional approval.

- Mortgage Approval –Approval means that you have met all the requirements and criteria for the loan and can proceed to close. Approval does not necessarily mean you will get the exact loan amount or interest rate you applied for, as these might change depending on market conditions or other factors.

- Mortgage Denial – Denial means that you have not met one or more loan requirements or criteria and cannot proceed to close. Denial can happen for various reasons, such as having a low credit score, a high DTI, a low LTV, a poor property appraisal, or insufficient income or assets. If you are denied the loan, you can try to improve your situation and reapply later, or you can look for other loan options or lenders with different standards or programs.

- Conditional approval – Conditional approval means that you have met most of the requirements and criteria for the loan but that you still need to provide some additional information or documents or that you need to meet some additional conditions before you can proceed to close.

Conditional approval is very common in mortgage underwriting, as some details or issues might need to be clarified or resolved before the final approval. Some common conditions include providing updated pay stubs, bank statements, tax returns, etc., clearing up any discrepancies or errors in your credit report, providing proof of homeowners insurance, etc. If you receive conditional approval, you should fulfill the conditions immediately and communicate with your lender and underwriter.

Summary of the mortgage underwriting process

Mortgage underwriting is a vital and complex process that determines whether you qualify for a mortgage loan and how much you can borrow. Mortgage underwriting involves evaluating your credit, income, and collateral based on various factors and criteria. Mortgage underwriters will appraise the value and condition of the property by looking at its features, location, market trends, comparable sales, etc.

Mortgage underwriters will also look at the loan-to-value ratio (LTV), the percentage of the property’s value you want to borrow. Generally, the lower your LTV, the better your chances of getting approved for the loan and a lower interest rate.

Mortgage underwriting can be done manually or automatically, depending on the type of loan and lender. Depending on the

evaluation outcome, mortgage underwriting can result in approval, denial, or conditional approval. By understanding how mortgage underwriting works and what to expect from it, you can prepare yourself better and increase your chances of getting approved for the loan and buying your dream house.