This guide covers credit scores used by mortgage lenders for qualifying borrowers and pricing mortgage rates. When you and your family apply for a mortgage, it is important to understand the basic qualifications. The three main pillars to qualifying for a mortgage are credit score, debt-to-income ratio, down payment, and equity position (loan-to-value).

The down payment on government loans does not impact the pricing on mortgage rates as much as conventional loans. The pricing of rates is not too affected on FHA, VA, and USDA loans due to the government guarantee.

This blog will detail how your credit score affects mortgage qualifications. We will also review the Fannie Mae agency guidelines on averaging middle credit scores for borrowers with multiple borrowers on conventional loans. This guide will cover credit scores used by mortgage lenders for pricing mortgage rates and qualifying borrowers.

Credit Scores Used By Mortgage Lenders Explained

First, it is important to understand what your credit score means. Most adult Americans are familiar with FICO, an acronym for Fair Isaac Corporation, the company that invented the scoring model. The FICO is a grade based on information combined in your credit reports. Typically, your credit score can range from 300 all the way up to 850. And, of course, the higher, the better.

There are three major consumer credit bureaus. They are Equifax, Experian, and TransUnion. Each credit bureau have slightly different algorithms that compute your credit score. This is confusing to most Americans.

It is important to understand that different scoring models exist for different industries. For example, you may buy a car at an auto dealership. You may be told you are a 780 when they pull your credit. At the same time, you may be applying for a mortgage, and the loan officer tells you your credit score is 740. This is difficult to understand, but each industry uses a different scoring model with different credit scores.

How Do Credit Scores Used By Mortgage Lenders Affect Interest Rates

Your credit score will determine which loan products you qualify for. Different loan programs, such as conventional mortgages, FHA, VA, USDA, and NON-QM mortgage loans, are available. Each different mortgage product has different credit score qualifications.

A 10 % down payment is required to qualify for an FHA loan with credit scores under 580 versus a 3.5% down payment for borrowers with 580 FICO and higher.

Whether you are a first-time or seasoned homebuyer, you need a 3.5% down payment on FHA loans. The Department of Veterans Affairs has no minimum credit score requirement on VA loans. Fannie Mae and Freddie Mac require a 3% down payment for first-time homebuyers and 5% down for seasoned homebuyers on conventional loans.

How The Down Payment and Rates Are Affected By Credit Scores Used By Mortgage Lenders

This section will discuss the minimum qualifying credit scores for government, conventional, and non-QM loans. HUD, the parent of HUD, has guidelines to qualify for FHA loans with a 500 – 579 FICO. For most Americans, buying a house is the most expensive item they will ever purchase. That is why mortgage scoring models are the strictest.

Many people are confused on the definition of a first-time homebuyer. A first-time homebuyer is defined as a person who has not had any ownership of a property in the past three years.

Conventional loans require a 620 credit score. There is no set minimum credit score on USDA loans. However, most lenders want to see a 580 credit for borrowers seeking USDA loans. Non-QM loans are portfolio loans and depend on the individual non-QM wholesale lender. You can qualify for non-QM loans with credit scores down to 550 FICO. Credit scores affect mortgage rates.

Credit Scores Used By Mortgage Lenders And How It Impact Rates

Once again, the higher the score, the lower the interest rate. The lender uses the middle of the three credit scores from the tri-merger credit report for the entire mortgage process. Borrowers should maximize their credit scores before applying for a mortgage loan. The credit score and credit report are good for 120 days.

A lower interest rate means a lower monthly payment. But more importantly, it means the less you pay over the life of the loan. Credit scores are incredibly important in the mortgage process.

There are loan-level pricing adjustments (LLPA) for borrowers with lower credit scores. Generally, mortgage rates can change every 20 points in credit score. For example, your mortgage interest rate will be the same if you have a 620 credit score or a 639 credit score. Every 20 points is the next price break in mortgage rates.

What Is Considered a Good Credit Score?

Below Are The Credit Scores Versus Grades:

- 500-579 = Bad credit

- 580-619 = Poor credit

- 620-679 = Fair credit

- 680-739 = Average credit

- 740 and higher = Great credit

What If a Spouse or Co-Borrower Has Higher Credit Scores

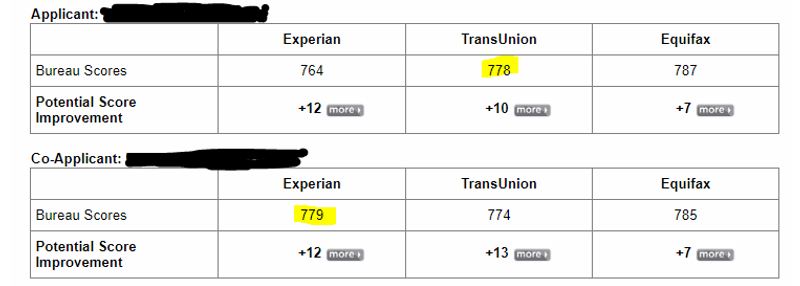

In the eyes of QM Mortgage Lending (Conventional, FHA, VA, and USDA), the middle credit score is used for mortgage lending. One step further, the lower middle score between applicants will be used. For example, if your middle score is 650 and your wife is 680, the 650 credit score will be used for mortgage qualifications. It is always the lowest middle score of all applicants. In the example below, the loan would be based on 778, the lower middle scores of the two applicants:

How Credit Scores Are Used By NON-QM Wholesale Lenders

Credit Scores Used By Mortgage Lenders Versus Other Creditors

Over the past few years, we have seen many credit-scoring companies emerge, such as credit karma. These are great tools for credit score tracking. However, the scoring models are based on consumer data and are inaccurate for mortgage lending.

Mortgage credit scoring models are called the 2, 4, and 5 scoring models. The lender is required to pull a tri-merged credit report. Meaning they pull the report from all three major credit bureaus.

Mortgage lenders use tri-merger credit reports because not every creditor reports to all three bureaus. The mortgage lender’s best interest is to receive as much credit data as possible. A report from all three is the best way to ensure they have information from all creditors. Lenders will also do a national public records search during the mortgage process.

Fannie Mae Guidelines on Averaging Middle Credit Scores For Borrowers With Co-Borrowers

Borrowers with co-borrowers can now have their middle credit scores averaged under the new Fannie Mae Guidelines on conventional loans. The middle credit score to qualify for a conventional loan is 620. So if the main borrower has a 600 credit score and the co-borrower has a 700 middle credit score, then the credit score will be the average between the middle credit score of 600 and 700, which is 650. Therefore, both of these borrowers will qualify for a conventional loan.

What Credit Scoring Model Do Mortgage Lenders Use

Below are the mortgage scoring models for all three bureaus. Notice the numbers 2, 4, 5:

- Experian – FAIR, ISAAC (VER. 2)

- TransUnion – FICO CLASSIC (04)

- Equifax – FICO CLASSIC V5 FACTA

From reading this article, you should be able to see the correlation between credit score and mortgage financing. We have seen every credit profile under the sun and are here to advise on getting your scores up. No two mortgage borrowers are identical, and everybody’s credit profile is slightly different. To keep a high credit score. Paying your bills on time and keeping revolving credit card balances low is important. Do all you cannot have collections hit your report. For any general questions regarding credit or mortgage financing, please contact Gustan Cho at 262-716-8151 or text for a faster response. Or email at gcho@gustancho.com.