In this guide, we will cover credit repair for mortgage approval. You do not have to hire expensive credit consulting companies to improve your credit to qualify for a mortgage loan. Companies can do more damage than good if you repair your credit to qualify and get a mortgage approved.

Consumers must realize that most credit repairing companies will go on a credit dispute rampage by disputing every negative credit tradeline on your report. Disputing every negative credit tradeline on your credit report is like shooting darts. Very rarely will negative items be removed with credit disputes with no documentation or proof that the negative tradeline is not yours.

Other credit repairing companies will have you commit fraud by getting a fictitious police report stating you were a victim of identity fraud. The best way to repair your credit is for free. Most seasoned, experienced loan officers will repair your credit for no charge. Borrowers must realize that older derogatory credit tradelines have little to no impact on credit scores.

Importance of Having Good Credit

In today’s world, a good credit score is essential for various reasons. Whether you’re looking to apply for a loan, rent an apartment, or purchase a new phone plan, your credit score plays a significant role in determining your eligibility. If you’re struggling with a poor credit score, you may consider credit repair services to help improve your standing. However, deciding which service is right for you can be challenging with so many options available. In this blog, we’ll explore how to select the perfect credit repair service for your needs.

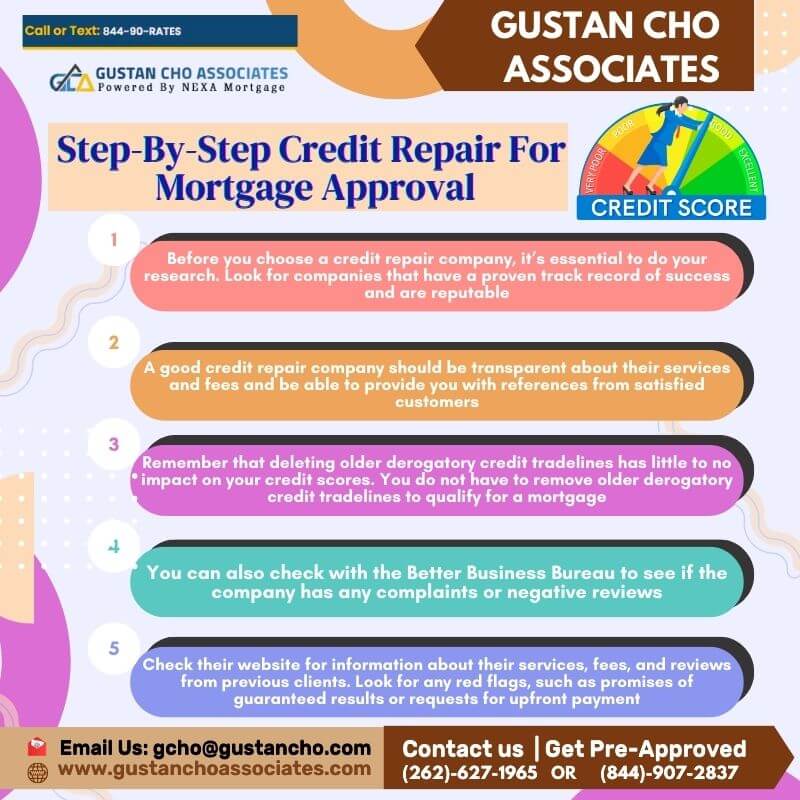

Step-By-Step Credit Repair For Mortgage Approval

Before you choose a credit repair company, it’s essential to do your research. Look for companies that have a proven track record of success and are reputable. A good credit repair company should be transparent about their services and fees and be able to provide you with references from satisfied customers.

Remember that deleting older derogatory credit tradelines has little to no impact on your credit scores. You do not have to remove older derogatory credit tradelines to qualify for a mortgage.

You can also check with the Better Business Bureau to see if the company has any complaints or negative reviews. Once you have a list of potential credit repair services, thoroughly research each. Check their website for information about their services, fees, and reviews from previous clients. Look for any red flags, such as promises of guaranteed results or requests for upfront payment.

Credit Disputes During The Mortgage Process

Credit disputes during the mortgage process are prohibited on non-medical collections and derogatory credit tradelines. You cannot have credit disputes on non-medical collections, late payments, charge-offs, or derogatory credit tradelines. Credit disputes need to be retracted for the mortgage process to proceed.

The reason credit disputes are not allowed during the mortgage process is when you dispute a credit tradeline, the credit bureaus will not count the negative scoring factor in the credit scoring algorithm. Therefore, when you dispute a negative credit tradeline, your credit scores will increase. When you retract the derogatory credit tradeline, the negative factor will be factored back into the credit scoring algorithm and your credit score will drop.

When selecting a credit repair service, consider your specific needs. Do you have a lot of negative items on your credit report, or are you just looking for a boost in your score? Some credit repair companies specialize in removing specific types of negative items, such as late payments or collections.

How Much Do I Have To Spend For Credit Repair

Most loan officers will help with credit repair to get you qualified and pre-approved for a mortgage for no charge. You do not need an expensive credit repair company to repair credit when a loan officer can do it for no charge. Most credit repair companies will do more damage than good.

There are many instances when credit repair companies will do a credit dispute, but when retracting the credit dispute, the creditor will not remove the dispute. This creates a big problem when trying to get approved for a mortgage.

Credit repair companies’ fees and services vary widely, so you must compare your options carefully. Some companies charge a flat fee, while others charge a per-item basis.

Does Credit Repair For Mortgage Approval Work

Take the time to read reviews and testimonials from other customers. This can give you a good idea of the company’s overall reputation and customer satisfaction.

Be wary of companies that promise to remove all negative items from your credit report or guarantee a specific credit score increase. These claims are often too good to be true and should be cautiously approached.

Look for detailed reviews that provide specific information about the customer’s experience. Contact past customers directly to ask about their experience with the company if possible.

How Do I Repair My Credit For Mortgage Approval

One of the best ways to find a reliable credit repair service is to ask for recommendations from friends and family. People who have gone through the credit repair process can provide valuable insights into the effectiveness of their service. Ask for references from people with a similar financial situation to yours.

While no credit repair company can guarantee specific results, some companies offer a money-back guarantee if they cannot improve your credit score.

Before choosing a credit repair service, check whether a reputable organization accredits them. The National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA) are two of the most respected accrediting organizations in the industry. Accreditation ensures that the service meets certain standards and has a proven track record of success.

Understand the Mortgage Process

Credit repair is not an overnight fix, and it requires a significant amount of time and effort. Choose a service that provides a clear and transparent credit repair process. The service should be upfront about the steps, timeline, and expected outcome.

Hiring a Credit Repair Consultant For Mortgage Approval

Finally, when selecting a credit repair service, it’s essential to have a conversation with the person in charge. This conversation will help you gauge their level of expertise and understand how they plan to help you.

Some credit repair companies may focus on overall credit score improvement. It’s important to choose a service that aligns with your goals.

A good credit repair person will take the time to explain the credit repair process to you and answer any questions you may have. They should be able to provide you with a clear action plan and an estimated repair process timeline.

Selecting the right credit repair service can be a game-changer for your financial future. By asking for recommendations, researching, checking for accreditation, and understanding the process, you can make an informed decision and choose the perfect service for your needs.

Some companies offer credit counseling or financial planning services in addition to credit repair. Be sure to read the fine print and understand what services you’ll receive for your fee.

Remember that credit repair is a process and requires patience and dedication, but with the right service, you can achieve your financial goals.

Getting Started Repairing Credit To Qualify and Get Pre-Approved For Mortgage

Before you begin the repair process and during the process, we have vast experience working with many buyers and sellers that need credit repair so that they can secure financing for their properties. We can take you through the entire process of acquiring financing and getting your credit ready or pointing you in the right direction for your next purchase.

Remember, it’s essential to take the time to do your research and choose a reputable company that aligns with your specific needs. By considering factors such as the company’s reputation, fees and services, guarantees, and customer reviews, you can make an informed decision and take the first step toward improving your credit score.

We also can connect you to title companies/attorneys and top real estate agents in your area that can help as needed. Call or text Ronda Butts at 407-460-7999 or email at ronda@gustancho.com for more information and further assistance on financing questions, comparing rates, and different loan options. Ronda is an experienced, dually licensed real estate agent and mortgage originator. She has successfully guided many homeowners through purchase and financing. She does not represent buyers or sellers but offers free consultations at Gustan Cho Associates by connecting homeowners, buyers, and sellers to the needed sour.