In this guide, we will cover down payment assistance for first-time homebuyers. We will discuss locating hard-to-find down payment assistance programs for first-time homebuyers. We will also cover the various types of DPA for first-time homebuyer programs available. Here is the definition of a first-time homebuyer:

By definition, a first-time homebuyer is a homebuyer who did not have any interest in a property in the past three years. You can have owned a property over three years ago but not in the past three years and be considered a first-time homebuyer.

Aspiring homeowners know the most significant hurdle to buying a home is the down payment. Fortunately, many down payment assistance programs are available to help potential homeowners achieve their dream of owning a home. This article will guide you through finding and securing down payment assistance. In the following paragraphs, we will cover qualifying for a down payment assistance program for first-time homebuyers.

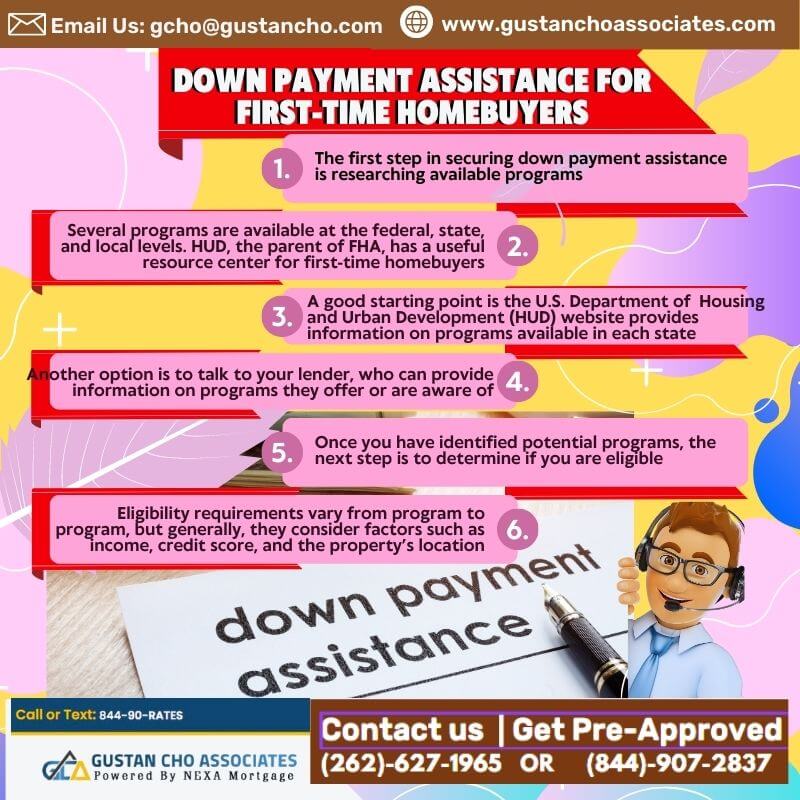

Research Down Payment Assistance Programs Available

The first step in securing down payment assistance is researching available programs. Several programs are available at the federal, state, and local levels. HUD, the parent of FHA, has a useful resource center for first-time homebuyers. First-time homebuyers can get a wealth of information about down payment assistance programs on HUD’s website.

A good starting point is the U.S. Department of Housing and Urban Development (HUD) website provides information on programs available in each state. Another option is to talk to your lender, who can provide information on programs they offer or are aware of.

Once you have identified potential programs, the next step is to determine if you are eligible. Eligibility requirements vary from program to program, but generally, they consider factors such as income, credit score, and the property’s location. Some programs target specific groups, such as first-time home buyers or military veterans.

How to search for State Down Payment Assistance

The best place to start is with your state housing finance agency. These agencies have access to various local and state down payment assistance programs. They can help you navigate the options and determine which programs you qualify for.

Some programs offer grants that do not require repayment, while others offer low-interest loans that must be repaid over a set time. Some programs may require you to complete a home buyer education course before you can qualify for assistance.

Your state housing finance agency can be found by visiting the National Council of State Housing Agencies website. They have access to various local and state down payment assistance programs. They can also recommend lenders who work with these programs and provide further advice on how to qualify for assistance.

Lender Overlays on Down Payment Assistance Programs For First-Time Homebuyers

Most DPA programs have lender overlays. Overlays are higher lending requirements than the minimum agency mortgage guidelines. Your state housing finance agency can also provide information on the different down payment assistance programs.

It is also worth checking with your city or county housing agency, as they may offer down payment assistance programs specific to your area. They can advise if there are any income or property restrictions for the programs and provide information on the application process.

It is essential to do your research and compare different programs. Not all programs are the same; some may have more favorable terms than others. Read the fine print and understand all terms and conditions before applying.

Researching the available Down payment assistance programs

Once you’ve found your state housing finance agency, it’s time to start researching and comparing the available programs. Each program will have specific requirements, such as income limits, credit score minimums, and home price limits. Make sure you understand the requirements for each program before you apply.

Apply for Down Payment Assistance programs

Once you’ve determined which programs you qualify for, it’s time to apply. Each program will have its application process, so follow the instructions carefully. Be prepared to provide documentation, such as income verification and proof of assets.

Applying for down payment assistance can be a complex process, so staying organized is important. Keep track of which programs you’ve applied for, the status of each application, and any documentation you need to provide. This will help ensure you don’t miss deadlines or lose track of important information.

The application process for down payment assistance programs varies by program. Some programs require you to apply before you purchase a home, while others allow you to apply after you have found a home. Some programs also require you to complete an educational course before you can receive assistance.

Types of down payment Assistance for first-time homebuyers

Down payment assistance programs come in different forms, including grants, loans, and tax credits. Grants are funds that need not be repaid, while loans must be repaid over time. Tax credits reduce the amount of tax you owe, which can help offset the cost of your down payment.

Gustan Cho Associates has a six-month forgivable down payment assistance program for first-time homebuyer or first responders. Requires a 620 credit score and the max debt-to-income ratio cap is 48.99% front-end and 48.99% back-end. Need to get a six percent seller concession.

As the housing market continues to heat up, many potential home buyers struggle with the down payment required to purchase their dream homes. Fortunately, there are several resources available to help buyers overcome this hurdle. Another is using the vast resources from your Realtor and Lender.

Use your Lender and Realtor as a source of Finding Down Payment Assistance

One of the best sources of information on down payment assistance is your lender or your Realtor. These professionals are experienced in home-buying and can provide valuable guidance on available resources. Many lenders and Realtors have established relationships with local organizations that offer down payment assistance programs.

Ronda Butts of Gustan Cho Associates is a dually licensed realtor | MLO and an expert in down payment assistance programs for first-time homebuyers. Ronda has both forgivable and non-forgivable down payment assistance programs for first-time homebuyers.

It’s important to note that not all lenders and Realtors are equal in their knowledge of down payment assistance programs. Be sure to choose a professional who is well-informed about this area of the home-buying process. Ask them about their experience working with these programs and whether they have recommendations for organizations that can assist you.

Research Government dPA Programs

Another great place to start your search for down payment assistance is with government programs. Several federal, state, and local programs offer grants, loans, and other assistance to help home buyers cover the costs of their down payments. Alaina Phillips at Gustan Cho Associates shares the following information:

Many government agencies in the city, county, and state levels offer grants or loans to cover down payment costs; some even provide additional support, such as homebuyer education and counseling.

The United States Department of Housing and Urban Development (HUD) is a great resource for information on government programs. You can also check with your state’s housing agency to see what programs are available in your area.

Check with Nonprofit Organizations

Nonprofit organizations are another excellent source of down payment assistance. These organizations are often dedicated to helping low-income families and individuals achieve home ownership. Alaina Phillips of Gustan Cho Associates shares the following thoughts:

Another option is to check with non-profit organizations specializing in down payment assistance. These organizations can help you find programs that match your specific needs and provide guidance on the application process.

To find nonprofit organizations that offer down payment assistance, you can start with a simple online search. Look for organizations in your area dedicated to affordable housing or home ownership. You can also check with your local housing authority or community development organization for recommendations.

Finding the down payment assistance program best for me

In conclusion, finding down payment assistance requires research and patience. By researching available programs, determining your eligibility, and completing the application process, you can secure assistance that can help you achieve your dream of home ownership. Remember that down payment assistance is just one of the options available to you, and you should evaluate all options before making a decision. Angie Torres, the National Operations Director at Gustan Cho Associates, advises the following:

Before you begin looking for a home and during the process, we have vast experience working with buyers to get them ready to purchase their dream home if they need down payment assistance. We can take you through the entire financing process for your home loan. We also can connect you to title companies/attorneys and real estate agents in your area that can help as needed that specialize in down payment assistance.

Contact Ronda Butts at Gustan Cho Associates at 407-460-7999 or text for a faster response. Or email Ronda at ronda@gustancho.com for more information and further assistance. Ronda is an experienced, dually licensed real estate agent and mortgage originator. She has successfully guided many homeowners through obtaining a home using down payment assistance on both the lending and real estate side. She does not represent buyers or sellers but offers a free consultation at Gustan Cho by connecting homeowners, buyers, and sellers to the needed sources.