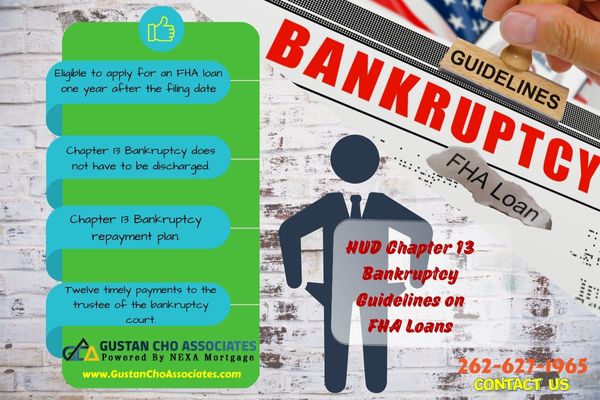

HUD Chapter 13 Bankruptcy Guidelines on FHA loans allow borrowers in an active Chapter 13 Bankruptcy repayment plan to qualify for FHA loans while in an active Chapter 13 Bankruptcy repayment plan.

The way HUD Chapter 13 Bankruptcy Guidelines state on HUD 4000.1 FHA Handbook is anyone who has filed Chapter 13 Bankruptcy is eligible to apply for an FHA loan one year after the filing date and after having made twelve timely payments to the trustee of the bankruptcy court.

The borrower can go through a home purchase and refinance FHA loan transaction. Most Chapter 13 Bankruptcy repayment plan terms are three to five years. The following paragraphs will cover the VA and HUD Chapter 13 Bankruptcy Guidelines.

Types of Bankruptcy

The way Chapter 7 Bankruptcy works are once you file Chapter 7, the bankruptcy process lasts 90 days before the bankruptcy court discharges the Chapter 7 Bankruptcy. Chapter 7 Bankruptcy benefits consumers without a consistent, stable source of income, little to no assets, and those with many outstanding debts. Any assets, except exempt assets, get liquidated to pay creditors.

Homebuyers and homeowners can get an FHA loan during and after bankruptcy. Bankruptcy is a federal law created to help consumers in debt. Bankruptcy gives Americans a fresh new start in their financial life.

There are many reasons why consumers file for bankruptcy. It can be because of extended unemployment, health reasons, prolonged medical illness, death in the family, loss of business, divorce, or other unforeseen extenuating circumstances.

Consumers Benefiting From Chapter 13 Bankruptcy

Chapter 13 Bankruptcy benefits consumers with a stable source of income and assets, and they need the help of the U.S. Bankruptcy Court to restructure their debts over time. Most Chapter 13 Bankruptcy repayment terms are for there to five years.

The bankruptcy trustee will allocate a certain percentage of the petitioner’s monthly gross wages to pay creditors. The set amount is paid to creditors until the Chapter 13 Bankruptcy repayment terms expire. Once the term is up, the bankruptcy court will discharge the balance of all the petitioner’s debts.

The consumer is now debt free and starts a fresh start. People can qualify for an FHA loan one year after filing Chapter 13 Bankruptcy. Chapter 13 Bankruptcy does not need to be discharged. They need to have made 12 timely payments to the bankruptcy court timely. Need trustee approval. It needs to be a manual underwrite.

Can I Get a Mortgage After Filing For Chapter 7 Bankruptcy?

Chapter 13 Bankruptcy guidelines on mortgage loans depend on the individual mortgage loan program. Each mortgage program has its own Chapter 13 Bankruptcy guidelines. Homebuyers and homeowners can qualify for a home loan during and after filing for bankruptcy.

FHA loans are the best and most common home loan program for first-time homebuyers, borrowers with high debt-to-income ratios, homebuyers with bad credit, and borrowers with bankruptcy.

Homebuyers and homeowners can qualify for non-QM loans with no waiting period after bankruptcy with no waiting period requirements with a 20% to 30% down payment. Non-QM loans are alternative portfolio mortgage loan programs offered at Gustan Cho Associates.

HUD Bankruptcy Guidelines on FHA Loans

There is a two-year waiting period requirement after the discharge date of Chapter 7 Bankruptcy. The requirements for getting a mortgage after bankruptcy depends on the type of bankruptcy the consumer has filed. For the sake of this blog, we will focus on FHA loans.

The two most common types of consumer bankruptcies in the United States are Chapter 7 and Chapter 13 Bankruptcy. Chapter 7 Bankruptcy is often referred to as total liquidation.

The two-year waiting period to qualify for an FHA loan after Chapter 7 Bankruptcy starts from the discharge date. Passing the waiting period requirements does not mean you will be guaranteed an FHA loan. Lenders expect to see timely payments after discharge with no late payments. Mortgage lenders want to see rebuilt and re-established credit after the bankruptcy discharge date.

Can I Get a Mortgage After Filing Chapter 13 Bankruptcy?

HUD and VA loan Chapter 13 Bankruptcy Guidelines are the only two mortgage loan programs that allow borrowers to be eligible for home loans during the Chapter 13 repayment plan. FHA and VA Chapter 13 Bankruptcy Guidelines are the same. HUD and VA loan Chapter 13 Bankruptcy Guidelines require manual underwriting for borrowers applying for a mortgage during an active repayment plan.

Homebuyers and homeowners can qualify for an FHA and VA loan one year after filing for Chapter 13 Bankruptcy. Borrowers need to have made timely payments during the repayment plan of the Chapter 13 Bankruptcy term. To be eligible, borrowers must have made 12 timely monthly payments to the bankruptcy court with no late payments.

Chapter 13 Bankruptcy Guidelines on FHA and VA loans have no waiting period requirements after Chapter 13 discharge. Per FHA and VA Chapter 13 Bankruptcy Guidelines, the file must be manually underwritten if Chapter 13 has not been discharged for two years.

Getting Approved For FHA Loans During Chapter 13 Bankruptcy Repayment Plan

VA and FHA loans are the only two mortgage loan programs that allow borrowers to qualify for mortgage loans during the Chapter 13 Bankruptcy repayment period. Chapter 13 Bankruptcy does not have to be discharged for homebuyers or homeowners to qualify for FHA or VA loans.

The team at Gustan Cho Associates has a national reputation of being able to do mortgage loans other lenders cannot do. Gustan Cho Associates is licensed in 48 states including Washington, DC, Puerto Rico, and the U.S. Virigin Islands.

If you are interested in qualifying for an FHA loan during the Chapter 13 Bankruptcy repayment plan without having your bankruptcy discharged, please contact us at Gustan Cho Associates at 262-627-1965 or text us for a faster response. The team at Gustan Cho Associates has no lender overlays on FHA loans during the Chapter 13 Bankruptcy repayment plan. Our loan officers and support staff is available seven days a week, weekends, and holidays.

This guide on Chapter 13 Bankruptcy Guidelines on FHA loans, was written on April 9th, 2023, by Eric Jeanette of American Dream Home Financing.